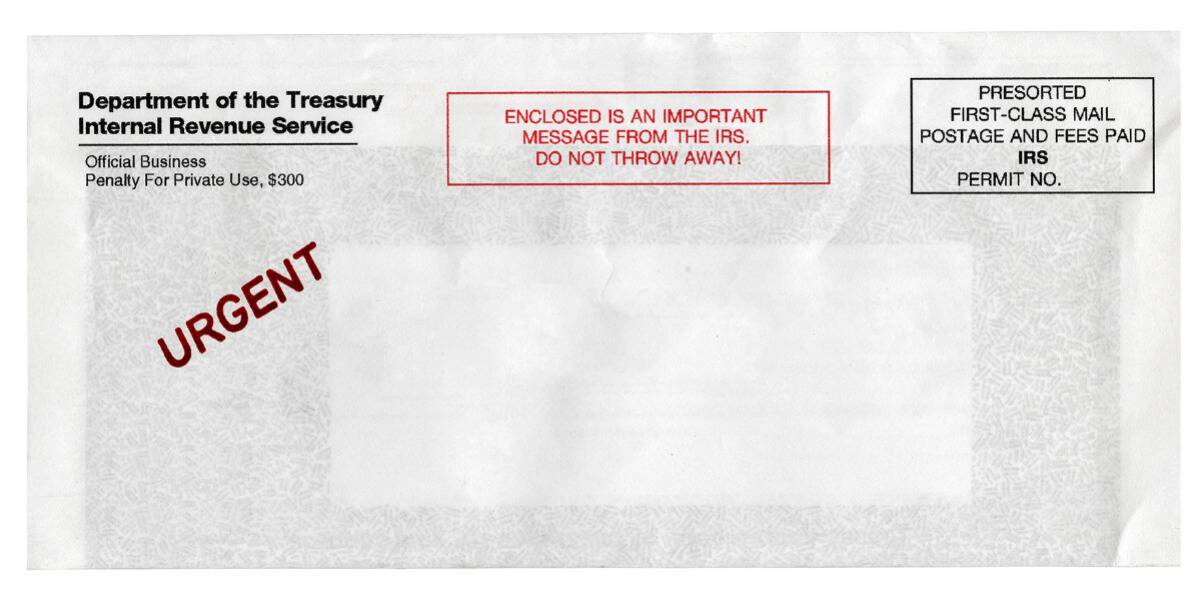

Even for honest taxpayers, the IRS can be extremely frightening. Unlike most other government agencies, the IRS has the power to attach your wages, freeze your bank account and even confiscate your property, and that is enough to send a chill up the spine of any taxpayer.

If you receive a letter from the IRS saying that you owe additional taxes, it is important not to panic. It may be a frightening situation, but there are things you can do to settle your tax debt and get back on the good side of the IRS.

Taxpayers do have options when resolving tax disputes and paying additional taxes due, and simply knowing what those options are can set your mind at ease.

As an expert Tax Resolution Firm, we encourage all readers facing a tax problem to contact us for a free consultation.

Regardless, it’s important to an educated taxpayer so here are three strategies you can use to resolve your tax debt and get on with the rest of your life. Not all of these options will be right for everyone, but it is important to be an informed taxpayer. The IRS may be frightening, but they can be surprisingly reasonable – if you know what to say and how to approach the situation.

Review the Amount Owed And Your Tax Return In Question

If the IRS says you owe money, you should not simply assume they are right. The tax agency does make mistakes, as do tax preparers and ordinary taxpayers.

Whether you filed your taxes on your own or hired someone else to do it for you, it is important to examine your return and compare what you find with what the IRS is claiming. It pays to seek professional help for this tax review, even if you originally filed your own taxes. A professional with IRS experience may be able to uncover errors and inconsistencies you would have missed on your own, and that could end up saving you money.

There is no guarantee this review will eliminate the extra taxes the IRS says you owe, but it never hurts to be sure. There have been many cases in which taxpayers who thought they owed money to the IRS ended up owing nothing – or even being due a refund from the IRS.

Set Up a Payment Plan

Getting a notice of additional tax due from the IRS is frightening, especially if you cannot afford to pay what the agency says you owe. Keep in mind, however, that you do not necessarily have to pay the bill all at once.

The IRS is often willing to set up payment plans with taxpayers, and those payment plans could make paying what you owe easier and less stressful. Once again, it is a good idea to seek professional help and guidance here – the IRS can drive a hard bargain, and you do not want to end up with a payment plan you cannot afford.

If you fall behind on the payment plan you agreed to, you could be subject to additional enforcement action, including the tax agency garnering your paycheck or even freezing your bank accounts. Getting the help of a tax resolution professional upfront can help you avoid these serious consequences.

Explore an Offer in Compromise Settlement

If you are truly unable to pay the money the IRS claims you owe, you may be able to work out a smaller payment. The IRS may not advertise this program, but the tax agency is often willing to work with taxpayers by accepting lesser amounts, especially if those taxpayers have few assets and a limited income. Sometimes these can be for a fraction of what’s owed if you qualify. We offer a free no-obligation consultation to find out if you qualify

If you plan to explore this last option, it is critical that you work with a tax resolution expert. These compromise offers can be extremely complicated, with legalese and language that can be difficult to understand. You do not want to make a misstep here, and you want to ensure that paying the compromised account will result in a complete settlement of your tax bill.

Few things are as frightening as getting a letter from the IRS. That official-looking letterhead is bad enough, but what the letter says is even worse. If you receive such a letter, you need to take positive steps right away. Ignoring the situation will not make it go away, and the sooner you start exploring your tax resolution options the better off you will be.

If you want the help of an expert tax resolution professional who knows how to navigate the IRS maze, reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options to permanently resolve your tax problem. Contact Us Today.